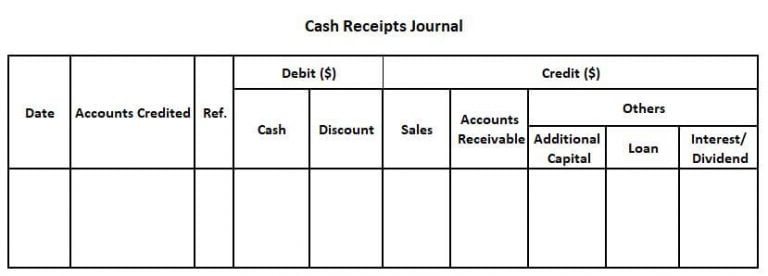

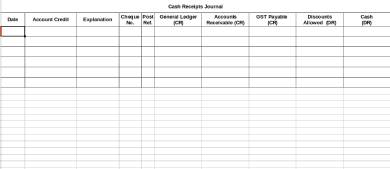

Test for the equality of debits and credits 4. Draw a single line across the six columns, below the last transaction 2. Return to cash receipts journal and enter the general ledger account number in post referenceįooting, Totaling, Proving and Ruling the CR Journal 1. Enter the journal letter and page number 3. Posting to the Accounts Receivable Subsidiary Ledger Enter a check mark in the post reference column in cash receipts journal enter the amount shown in the acct/rec credit column of the cash receipts journal Enter the post reference CR-cash receipts Enter the date of the transaction in the ledger account Posting to the Accounts Receivable Subsidiary Ledger Daily postings are made from the Accounts Receivable Credit column to the accounts receivable subsidiary ledger Ensures that customer accounts are always present Recording Cash Sales Business Transaction On December 15, On Your Mark records the cash sales for the first two weeks of December, $3,000, and $180 in related sales taxes, Tape 55. Recording Cash Received on Account, Less a Cash Discount Business Transaction On December 12, On Your Mark received $1,470 from South Branch High School Athletics in pay- ment of Sales Slip 51 for $1,500 less the discount of $30, Receipt 302. Recording Cash from Charge Customers Business Transaction On December 5, On Your Mark received $212 from Casey Klein to apply on account, Receipt 301. Every transaction recorded in cash receipts journal REQUIRES a debit to cash in bank.Special journal used to record all cash receipt transactions.Use of cash receipts journal will save time and reduce errors.

Cash receipts journal how to#

How to prepare a schedule of accounts receivable.

How to post amounts in the general credit columns of cash receipts journal to general ledger accounts.

0 kommentar(er)

0 kommentar(er)